The financial technology, or fintech, industry is on the rise to provide users with improved and automated financial services. By 2022, it’s projected that over 65% of the US population will be using digital banking.

Fintech app marketers need to utilize a mobile measurement partner (MMP) and establish a measurement strategy for optimal user insights and app performance metrics. Depending on your fintech app category, these metrics will vary. Learn about the five most important measurement best practices fintech apps should incorporate into their marketing strategy.

Upgrade from Free App Analytics® to grow your marketing strategy.

Fintech categories

Fintech is an app category that deals with money/finances and can range from mobile banking to educational money apps. Below is a list of fintech categories and corresponding app examples.

- Banking (eg, Bank of America)

- Budget Management (eg, Intuit Mint)

- Buy now, pay later (eg, Afterpay)

- B2B services (eg, Stripe)

- Credit Management (eg, Credit Karma)

- Crytpo (eg, Coinbase)

- Financial Education (eg, Zogo)

- Insurance (eg, Geico)

- Investing (eg, Robinhood)

- Loans (eg, Brigit)

- Online Bank (eg, Chime)

- Payments (eg, Apple Pay)

- Personal or Business Tax (TurboTax)

- Money Transfer (eg, Western Union)

Measurement Best Practices

Unlike gaming or social apps, fintech apps are a tool employed to simplify and optimize the user’s life. Typically, financial apps are installed and/or used cyclically to transfer and deposit money, view transactions and trends, or submit claims and information.

When measuring your fintech app with a mobile measurement partner (MMP) like Kochava, be sure to capture the key performance indicators (KPIs) that are relevant for your application. For example, the main KPI for a money transfer app will be to get users to complete their first money transfer, whereas investment apps like Robinhood or Acorns want users to connect a funding source to make their first trade.

No matter the KPIs you choose to measure, correctly setting up insightful in-app events will provide you with a view into your user’s journey while showing you what goals are being completed and which users are completing them.

1 – Communication Between Marketers and Developers

No matter the type of app or where you are in your marketing journey, an important step in any marketing strategy is to ensure clear communication between marketers and app developers. Marketers should decide what information is the most important to measure to achieve growth goals, and developers need to listen to the needs of the marketer while communicating what can be accomplished. Together, marketers and developers should decide upon naming conventions for events and metadata passed with each event so that the information can be clearly understood and analyzed.

2 – Configure Insightful Events

Post-install events allow marketers to gather information that can be used to calculate user quality and/or lifetime value (LTV) by measuring the user’s journey through an app after install. Within the Kochava platform, almost any in-app action can be passed as an event. When creating events, decide which steps in the engagement funnel you need visibility of to measure success. If you plan to run reengagement campaigns, a healthy funnel of events will provide drop-off points that can trigger reengagement efforts. Further, think about which events you may need for app event optimization with partners like Facebook, Google, and others.

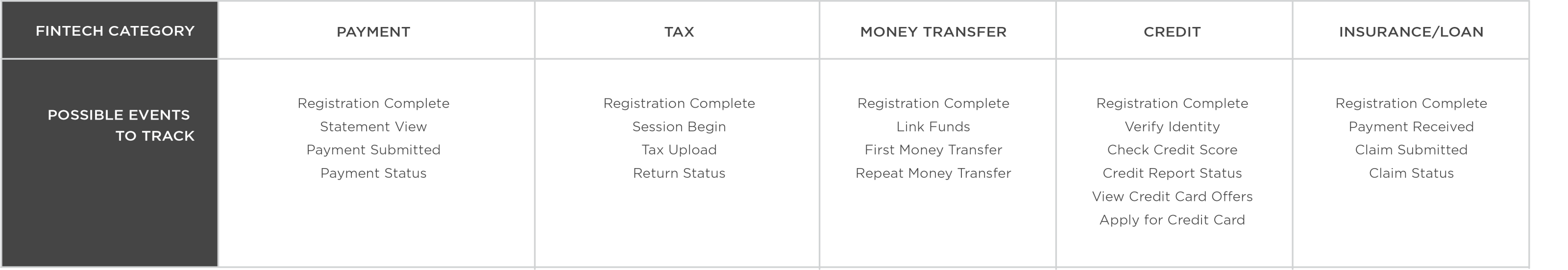

Depending on the type of fintech app, tracked events could include:

These are a few examples of custom events that fintech apps could implement. However, each app is different and custom events will vary from app to app. Talk to your MMP representative about your marketing goals and they can assist in guiding you toward the right events to track.

3 – What Metadata to Include

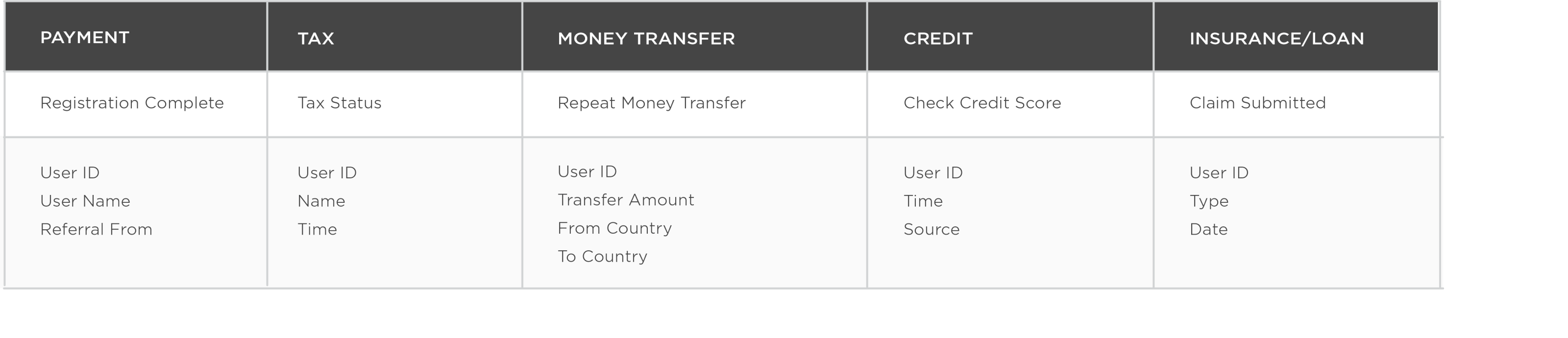

Gain even more insight from your events by including metadata. Each event can be broken down into detailed parts to further your understanding of each data point.

For example, a loan app might have a variety of claim events. By passing metadata, you can determine which claim each user submits (auto, home, personal, etc.) and the date it was submitted along with any other metadata you choose to best measure the user journey. For each event, there are a number of metadata points that can be configured, for instance:

With metadata, marketers can gather more granular detail on each event they configure. For more information on how to utilize metadata, read the support documentation here.

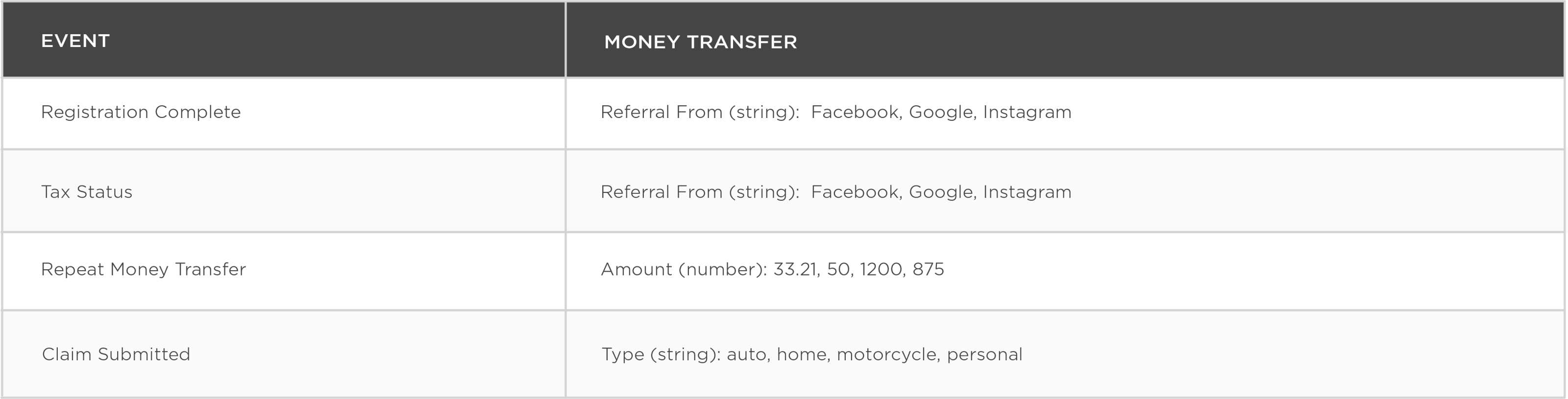

4 – Naming of Events and Metadata

As you add events and metadata, it is important to name each of them with titles that are easy to understand. Events should be titled with the action they represent and the metadata under each event should clearly state what data is being passed. For example:

5 – Optimize To Install-to-Event Completions

The rich install and event data gathered by your MMP can be analyzed to see install to event completion across all of your app users and answer questions such as:

- Once a user installs the app, how many events do they complete on the first app open?

- What functionality in a fintech app do users utilize the most?

- How often do users go into the app and complete events?

- What marketing strategies acquire quality users that reach in-app KPIs?

By answering these questions, you can start to optimize the user journey and refine your marketing. Perhaps you notice that many users are not utilizing a certain functionality within your app. With that information, you can determine why it’s not getting used and find a way to fix it.

Conclusion

When it comes to fintech apps, there are many things to consider when creating or optimizing your marketing strategy. Based on what fintech category your app falls into (eg, payment, loan, money transfer, banking), decide which events to track and metadata to include to gain the most insights into the user journey. Aside from measurement, determine what additional features and tools your app should include that will provide your users with the best experience.

Do you have questions about what in-app events you should measure in your fintech app? Contact us at support@kochava.com.