Why clean and clear target audience segmentation is important across partners.

How well are your network partners working for you?

In a perfect world, you run campaigns with multiple networks to cast a wide net and improve overall reach. The goal is healthy acquisition of unique, high quality users at an efficient cost per install (CPI). However, if you’re not being specific enough in your targeting segmentation, heavy overlap in your media mix may be inadvertently driving up your CPI.

A crowded media mix leads to high CPI

User acquisition is far more complex than direct return on ad spend. If it were that simple, marketers would pile their spend into their best campaigns. As it is, when networks overlap, targeting the same user in the customer journey, not only is the user experience more likely to suffer from oversaturation, it can also result in network partners receiving confusing postback signals for optimization.

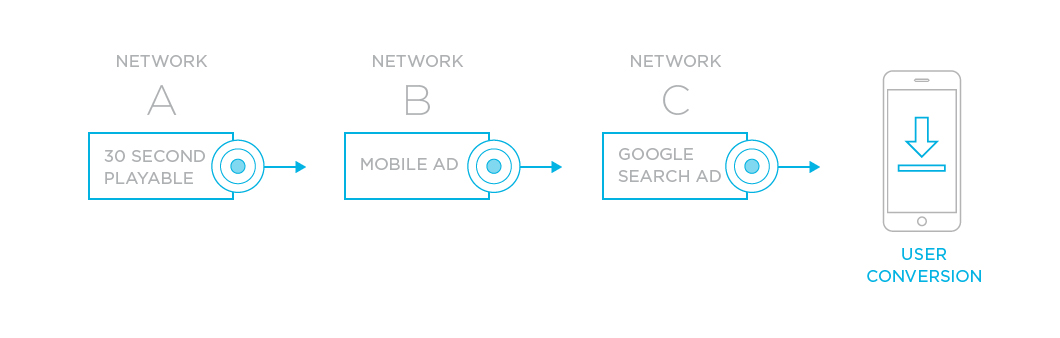

Suppose a particular user lands in the same target audience criteria (females, US, 18-25, casual gamers) for campaigns across three different partners. Each partner correctly targets the user and serves them an ad. Network A serves a 30-second playable that captures the user’s attention. The user goes back to playing the game they were already in, but a positive imprint has been made that they want to try this game later. An hour later, Network B serves them an ad on mobile web, while the user is reading an article. They don’t click on the ad, but go to the app store and search the game, at which time Network C serves a Google Search ad and the user clicks it.

With fractional attribution, marketers would be able to distribute credit with various weighting based on influencer positions (ie, winner = 75%, first influencer = 15%, second influencer = 10%). While Kochava has long supported this model of attribution, industry adoption is stale and thus, we’re stuck with the “last touch takes all” model. The winner (C), gets paid for their targeting, but the networks that had influence touch points (A and B) get install postbacks informing them they lost. By losing attribution, they will optimize away from your target audience (even though in this case, the targeted user became a customer!) and their CPI will rise because they believe they have to serve more ads to obtain users.

You as the marketer only pay the CPI bounty to Network C. However, the efforts of networks A and B should not be mistaken as being “free.” When multiple networks generate impressions and clicks on the same user, all networks except the attribution winner believe their targeting was unsuccessful and will try not to serve impressions to users like that of your new user. The more this happens, the more impressions it takes to generate an install or action, thus lowering your eCPM and reach, while increasing your CPI. You’ll also apply this flawed logic to your ongoing marketing strategy.

Beware of overlapping with the walled gardens

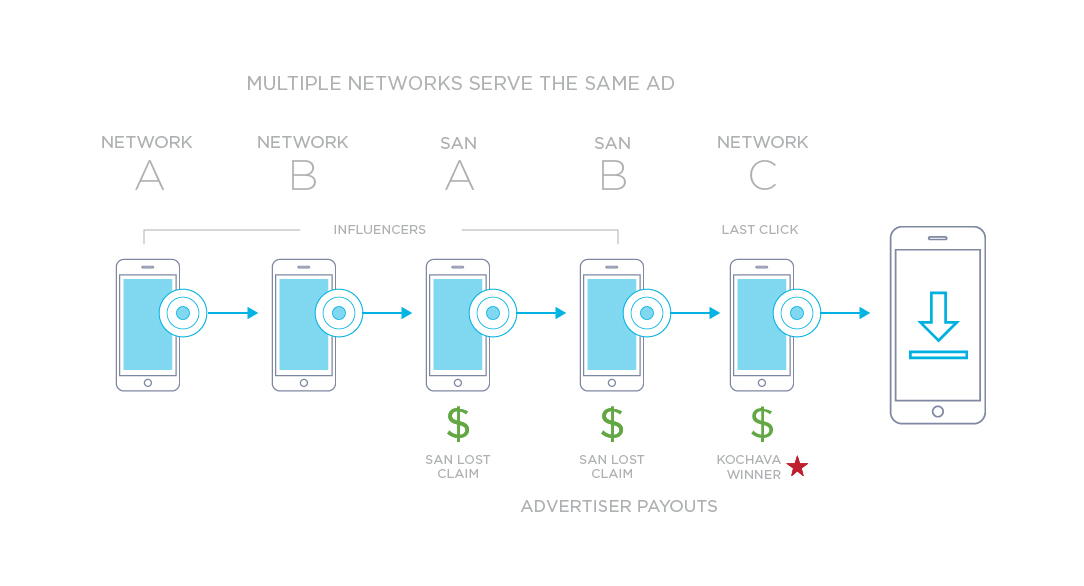

This same conundrum becomes even more costly when it’s done with the walled gardens, also known as self-attributing Networks (SANs). SANs include Facebook, Google, Twitter, Snapchat, and several other major ad platforms. These partners play by their own rules when it comes to attribution. They charge per click (rather than CPI) and claim the installs that occurred on their platforms. So, instead of mobile measurement providers like Kochava notifying them whether they won attribution, it’s the other way around. They inform Kochava and others what they won.

When a SAN claims an install and conflicts with a mobile measurement provider’s (MMP) determined attribution winner, the marketer is stuck paying at least twice for the same install. They’ll pay the non-SAN network the CPI attributed by their MMP. However, they’re still billed for the clicks it took to drive the install on the SAN.

In the example below, two SANs claimed the same install in addition to the network that Kochava identified as the attribution winner—in this case, that means paying three times for the same install. This can be avoided with the right tools and information.

You want networks to deliver unique, quality installs of users who will perform downstream events.

How an overlapping media mix can cost you

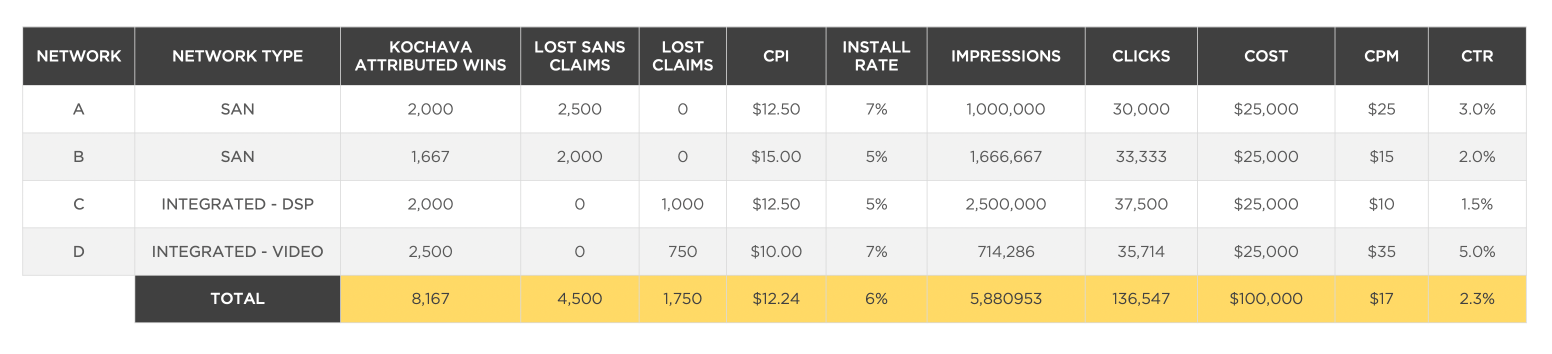

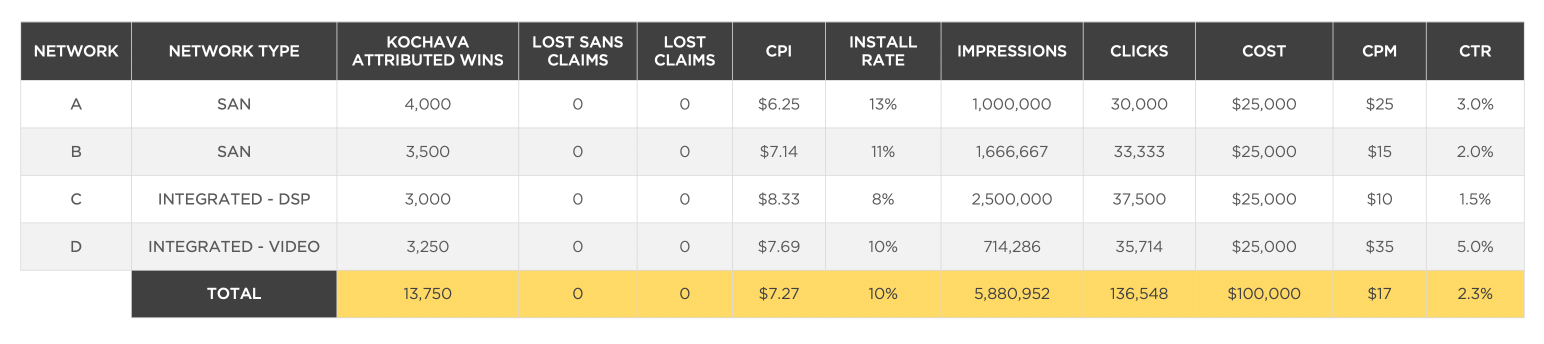

Suppose a company wants to advertise their new app to 100,000 of their previous app’s customers. They upload this entire audience to four networks with which they’ve had prior success in user acquisition. Each network gets a $25,000 budget to activate as many of these customers as possible. Knowing that these are high value customers, the marketing team sets an internal goal of a $10 CPI or better.

Despite testing their creative in a soft launch, marketing toward prior customers, and working with proven user acquisition networks, the target CPI of $10 is exceeded. Why were the CPIs higher than expected, and why were the click-to-install rates far lower than average? The problem is found by looking to the table columns titled, “Lost SANs Claims” and “Lost Claims.”

SANs will claim install conversions for users who have seen and/or clicked on one of your ads through their platform, within their lookback windows. However, this is an incomplete view, as one of the other networks may have been more meaningful to attribution in terms of proximity to install or click vs. impression intent. Kochava reports installs that are claimed by a SAN, but end-up being attributed to another source, as a “lost SAN claim.” In Kochava’s standard attribution model, there can be only one winner, but in this scenario, the app developer will be charged by multiple ad networks for it.

To the non-SAN network that won attribution in Kochava, a CPI will be paid out. To the SAN that claimed the install in their own eyes, the target CPI is still paid through the cost per click on the campaign. Integrated networks will only claim an install when Kochava attributes one to them. That being said, this attribution deferral should not be mistaken for being “free” as it decreases the precision of targeting. In fact, you probably cost yourself an install for each of these overlaps. Why? Well, when an integrated network targets a user who saw or clicked on your ad, but did not receive the install credit, it is counted as a “lost claim.” When multiple networks generate impressions and clicks on the same user, all networks except the winning attribution now believe their targeting was unsuccessful and will try not to serve impressions to users like that of your new customer. This is not the type of feedback you want your network partners to optimize on.

In short, all four networks were focused on getting credit for bringing in the same users instead of acquiring as many unique users as possible.

Now, if instead each network was given a unique audience to target, the impression, click, cost, and click-through rates were far better. Without targeting overlap, lost claims were eliminated, and integrated networks did not lose claims on any installs they touched on attribution. This caused the install rate to nearly double, and CPIs to nearly half. Not every “lost SAN claim” or “lost claim” from the previous example is counted as a new attributed install, because some installs had three or four networks claiming against the same user. Due to the lack of overlap, the total marketing spend efficiency increased by nearly 50%.

Best practices to adopt

In an overcrowded media mix, the number of unique, quality installs decreases. If you’re not sure how much your media mix currently overlaps in targeting, we can help. You can visualize your media mix within Kochava through the influencer report. This report shows which networks had a touchpoint with a user before the last click was awarded.

Once you know how much you’re overlapping, these best practices to help you optimize in the future:

Avoid: Sending the same advertising identifiers for targeting to more than one SAN.

Solution: If you have a list of prior customers or power users, segment them by the network they were originally acquired from as that network has proven the ability to reach the user. Whenever targeting specific users on a network, make sure to blocklist those users from all other networks to prevent overlap. Once a network has failed to reach a user, then remove them from all blocklists and try a new network or multiple networks.

Avoid: Running multiple media partners who purchase inventory from the same providers.

Solution: Focus on a network’s targeting expertise to prevent overlap and improve the uniqueness of audiences. Let’s say two demand-side publishers (DSPs), Network A and Network B, have different specializations. Network A is known for having a large US audience, and Network B is known for reaching Android devices in Brazil. To avoid overlap, set your targeting preferences to each network’s region of expertise and consider negative targeting for the Portuguese language from Network A if they support it. Just because a network has incredible reach doesn’t mean you need to allow them to spend on untargeted run of inventory campaigns.

Avoid: Scaling by increasing partners and lowering CPI/CPA bids.

Solution: Ask account managers what eCPM is required to achieve the targeted impression reach, and then test and compare click-through and install rates with other similar partners. A high click-through rate may not be indicative of higher performance, as a low impression-to-click ratio can suggest click flooding. Low install rates suggest low-quality leads. If your app store page can convert browsers into users, ask why it would take hundreds if not thousands of user clicks to your page to get a single install. A “click” should measure intent, not be an attribution catch-all for less scrupulous networks.

The takeaway

Sometimes less is more. By adding additional networks to your media mix, you may cause overlap and decrease your overall performance. Kochava offers many tools, filters, and settings to prevent costly targeting overlap. Contact us to learn what overlap may exist in your media mix and how we can help optimize your future ad spend. The Kochava team can even do the heavy lifting for you, if you prefer.

Kevin King – Lead Client Analytics

Kochava