How many clicks should it take to drive an app install? Should it take 100? 500? 1,000? 1,000,000?

Before answering, let’s define what a “click” means. In marketing, a click represents a mobile user seeing an ad and being interested enough to show their intent to convert by tapping on that ad. The click sends them to the app store where they can install.

If intent is what a click represents, then we should never see a media partner or publisher sending thousands or millions of clicks that result in only 1 or 2 installs. It’s implausible that 1,000,000 real people clicked on an ad but then 999,999 of them abandoned their interest once they reached the app store, leaving only one real install. And yet, all too often, we see these unreasonably high CTI (click to install) ratios.

The number of clicks matters because you want to see results based on the actions of real users, and you want to know if there are fraudulent clicks muddying your traffic. If you’re only focused on installs, you’re blind to click flooding which leads to misattribution or the stealing of organic installs.

Clicks should correlate with installs

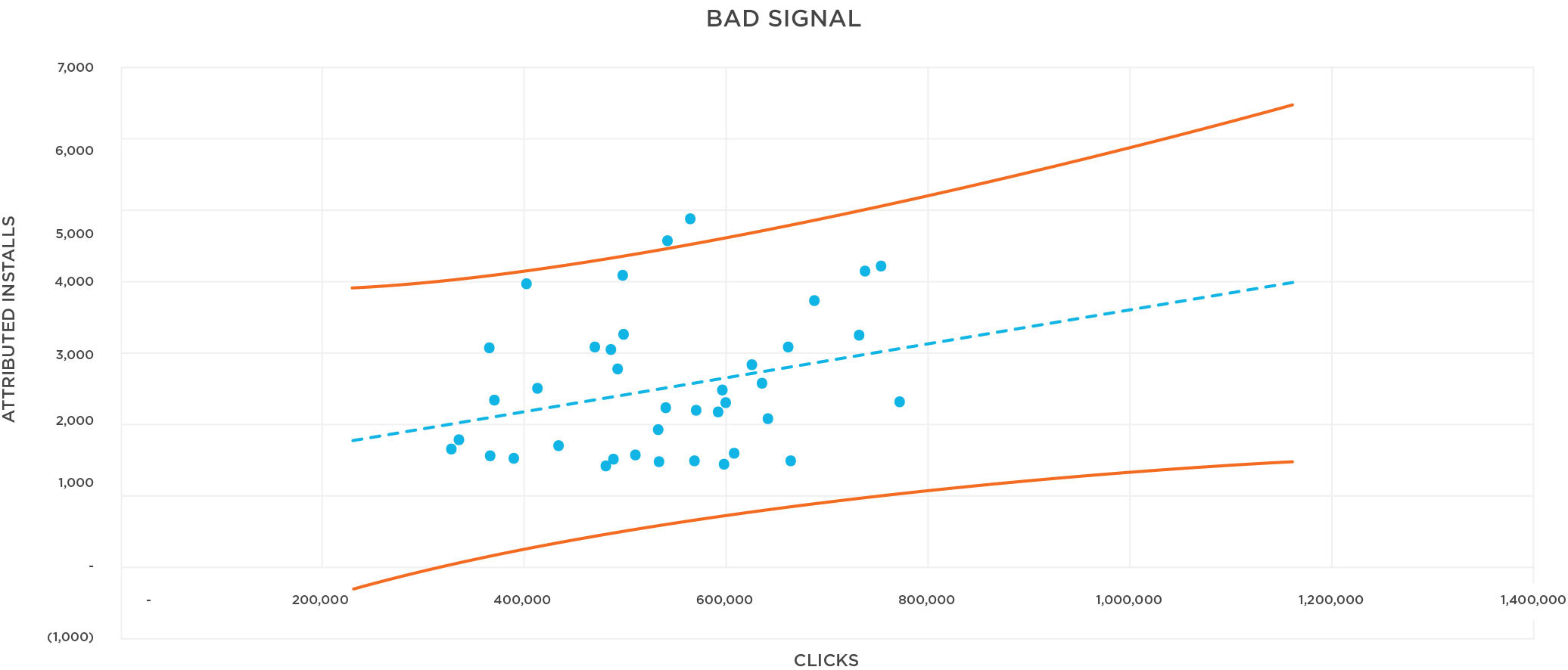

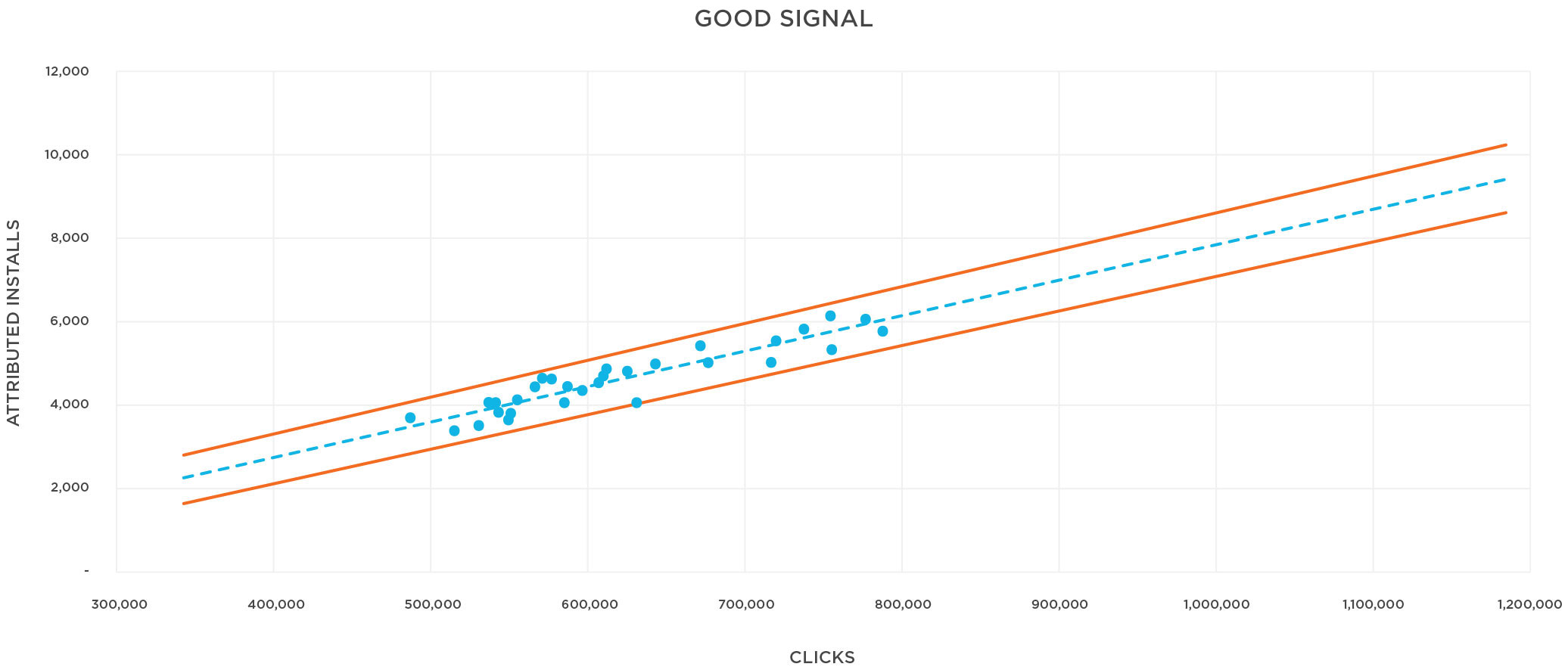

Mobile marketing is a cause-and-effect strategy game. When a media partner drives up click volume, we expect to see a similar rise in conversions. This is good correlation—the strength of the causal relationship between clicks and installs (top image). If we see major peaks and valleys in a partner’s click volume, but no impact on the conversion trend line, correlation is weak or absent (bottom image).

Having a weak correlation indicates a problem that should arouse suspicion. Unfortunately, as a measurement provider, Kochava regularly records a CTI ratio of 1000:1 from media partners, which is unrealistic (and we’ve seen beyond that!).

The myth of CPI is that clicks don’t matter

There is a common misconception in marketing that if a marketer is paying on a cost per install (CPI) price model, the number of clicks isn’t important, only the final outcome of those clicks (i.e., the install count) is important.

Let’s say partners A and B both drove 1,000 install conversions. Partner A delivered 1,000 installs by driving 10,000 clicks (a CTI ratio of 10:1). Partner B drove 1,000,000 clicks to deliver the same number of installs (a CTI ratio of 1,000:1). Should partner A and B be considered equally successful in their campaign execution because their CPI outcome was the same? Or should the question be, why did it take partner B 100x the click volume to deliver the same amount of installs as partner A?

By ignoring the CTI rate, marketers are frequently paying the wrong partners. It also means that organics are likely being stolen/misattributed, which translates into marketers paying for installs that their brand equity—not their paid advertising—drove.

Additionally, not removing fraud from campaigns means that return on investment is skewed, and marketers are basing their decisions on erroneous data. The most likely cause for having a misaligned correlation is click flooding—when publishers send fake clicks to win attribution.

Smart marketers can protect themselves by:

- Monitoring click volume and CTI ratio in the Fraud Console. If there are low conversion rates and high CTI ratios, they request an improved conversion rate and/or blocklist offending site IDs to prevent misattribution.

- Consulting the Kochava Traffic Index report (for free each quarter) to see which partners are ranked high for correlation.

- Consulting the Kochava Traffic Index for partners with good signal clarity and requesting they send clicks and impressions separately.

Ensure good signal clarity for a strong correlation

A clean signal with a strong click-to-install correlation is the only way to predict the number of installs from a planned campaign.

Work with your Client Success Manager on how to approach partners if the correlation metric is off and how to customize lookback windows to mitigate fraud and increase your signal clarity for stronger correlation.