iOS marketers have been forced to evolve

For many iOS app marketers, Apple Search Ads (ASA) is no longer an optional line item in their ad spend budget. Brands must bid on their own brand keywords or risk losing visibility in the App Store. Throw in Apple’s Store Kit ad network (SKAdNetwork), which severed the adtech industry’s near real-time feedback loop, leaving brands guessing, struggling to understand the relationship between their paid media and conversions, and you have the perfect catalyst forcing even more demand into ASA.

It’s the perfect storm, and it’s all thanks to Apple’s AppTrackingTransparency (ATT) framework and SKAdNetwork. Thankfully, you don’t have to passively accept the new normal. To take control of your performance potential, consider implementing a strong test-and-learn strategy and partnering with a mobile measurement partner (MMP) like Kochava.

ASA’s ascension

Let’s start by looking at a single advertiser. They’re a streaming entertainment brand we’ve all heard of that has been around much longer than I’ve been alive. This brand is likely front of mind for most users in the U.S. when they think of “Entertainment Media.”

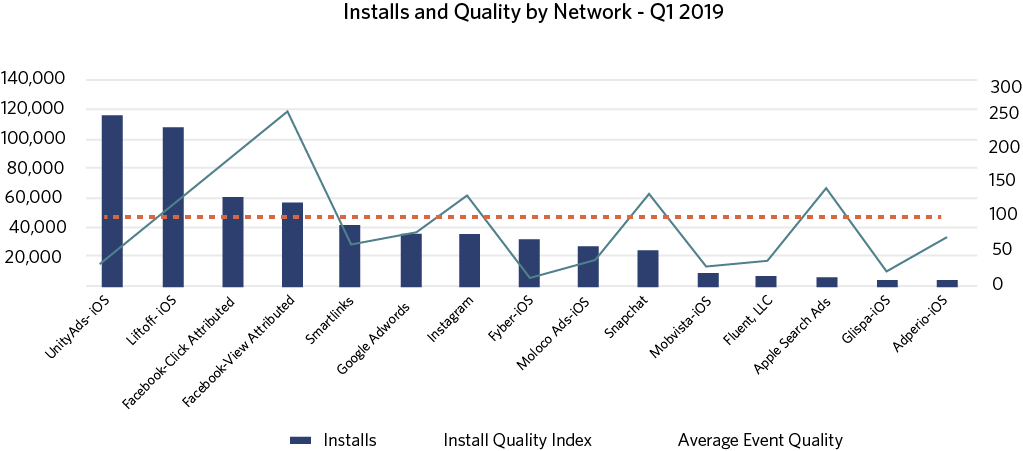

Three years ago, this brand spent ~$2.4M monthly on iOS user acquisition (UA) for their main app. The spend was spread across 17 networks, and the UA team had a strong test-and-learn strategy. The networks at the time included DSPs (e.g., Aarki, Liftoff, ironSource, Molocco), self-attributing networks (SANs) (e.g., Facebook/Instagram, Google, Snap, TikTok, etc.). At the time, ASA was 13th on the list, with a monthly spend of ~$44k.

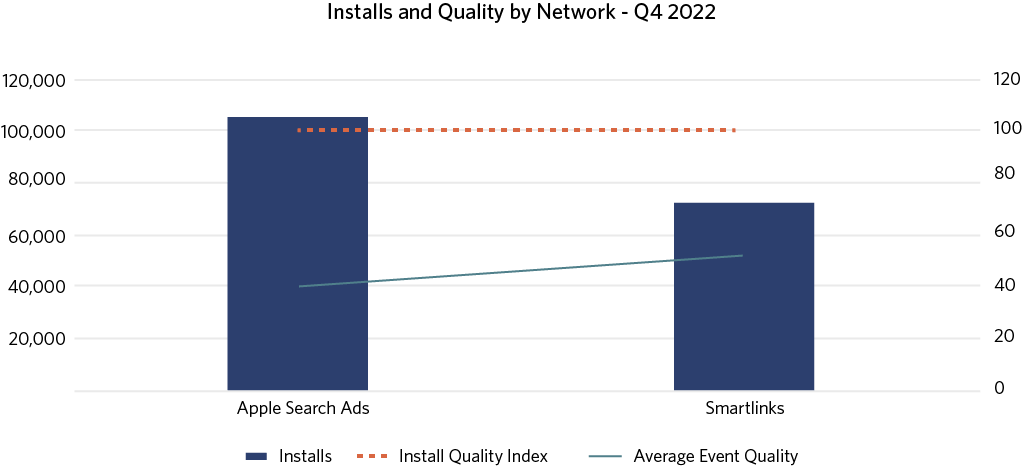

Fast forward to the present (Q1 2023) – the brand now runs on two networks:

- ASA $830k

- Owned media (via Smartlinks)

As you can see, their growth has greatly flattened.

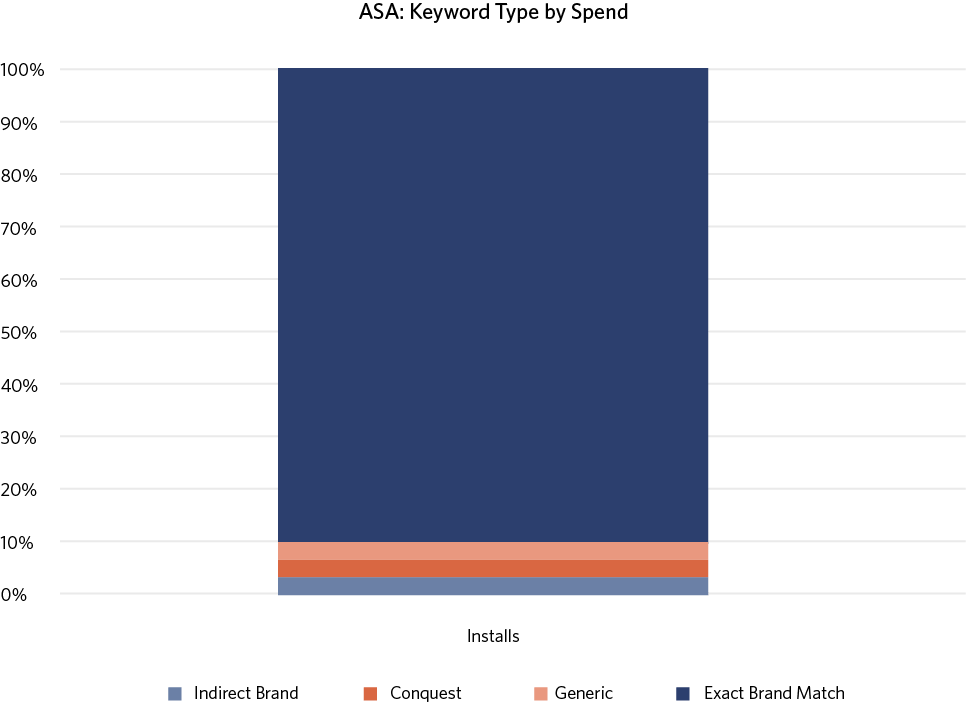

This is a sad new reality for most brands: 38% of iOS install attributions are now awarded to ASA. And when we break down the keywords tied to that spend, 95% are against their own brand’s term.

What is being purchased with ASA? A light blue ad with white text that the user likely doesn’t even know is a paid placement? It’s reasonable to assume that most users were looking for the brand they knew but were snared by ASA. If you don’t bid against your own brand, your competitors will.

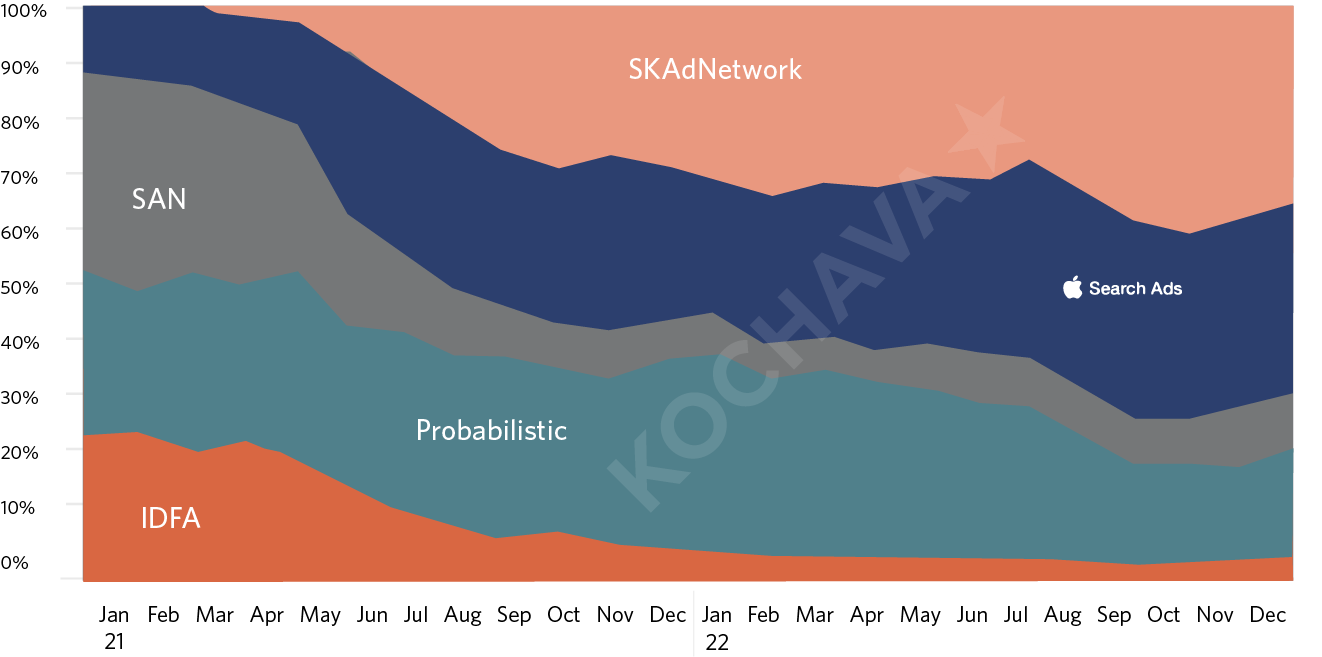

The recent redistribution of media

Here’s the broader view of how media attribution has been redistributed over the past two years in the iOS advertising ecosystem.

What the heck happened? The ATT framework and SKAdNetwork happened. ATT enforcement hit at the end of April 2021, and by May, most devices were capable of carrying the ATT prompt. SKAdNetwork started to see wide adoption in the summer of ’21.

A quick recap of direct response mobile marketing

Let’s take a beat for a history lesson on direct response mobile marketing.

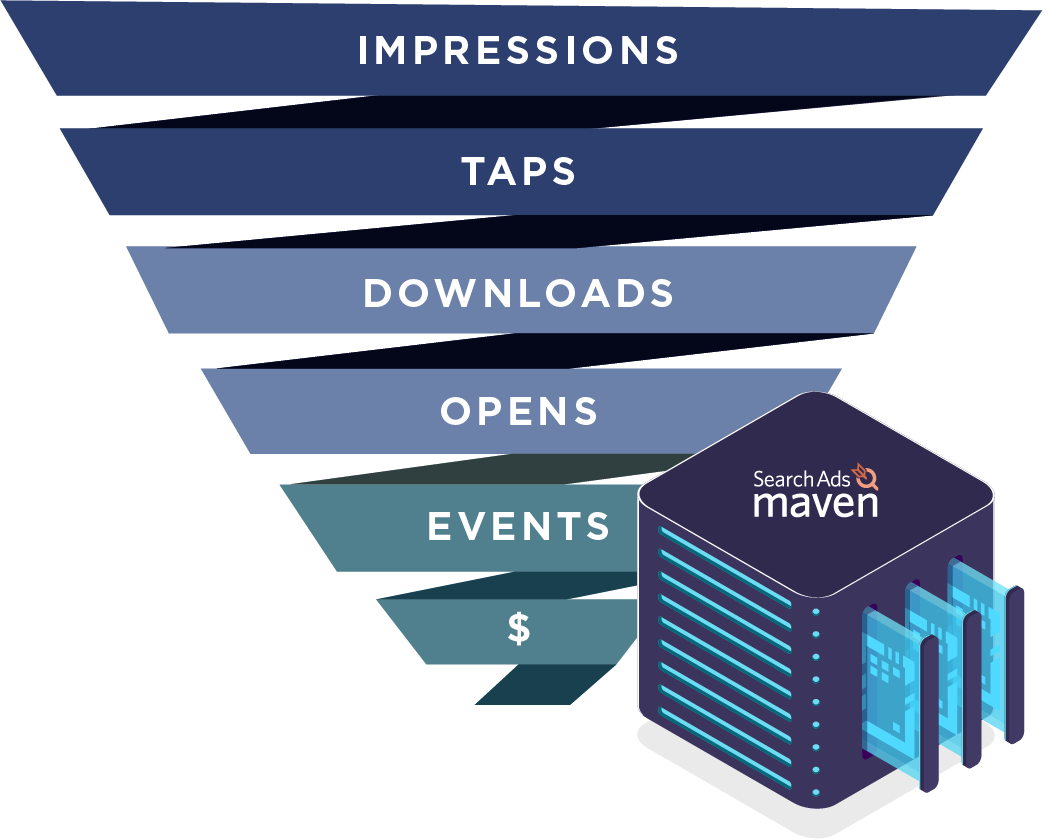

Within the mobile marketing ecosystem, an MMP provides the ability to track the relationship between an advertiser’s conversions and their paid media. In the case of Kochava, the advertiser implements our software development kit (SDK) into the app, and to the extent the advertiser wants to track conversions, they implement those conversions to be read by our SDK. These conversions could be installs, post-install registrations, paid sign-ups, purchases, etc.

The advertiser (brand) comes into the MMP platform and creates campaigns to be trafficked by the ad networks. Links are used when ads are served, and different links are used when users click on or interact with the ads. Additionally, Kochava has control servers located all over the planet, allowing us to read an ad signal in real time. Our SDK can also read the conversions that advertisers wish to tie back to media (installs, registrations, purchases, etc.) in real time. Depending upon the advertiser’s attribution waterfall logic (which is fully customizable with Kochava), we answer the question of what the ads did relative to the target conversion(s), and we can syndicate that answer anywhere on the planet within 120ms. Then came SKAdNetwork.

Now back to SKAdNetwork

If you’re interested in the detail of how SKAdNetwork works, I’ll refer you to this page, which has a wealth of resources on the topic.

In summary, the 120ms feedback loop that the mobile adtech industry relied on was severed; iOS campaign results via SKAdNetwork are mostly NULL (more on that later), but even when visibility occurs, it’s delayed and aggregated. So whereas the programmatic engine of a brand’s mobile advertising was making decisions in near real time, with SKAdNetwork they now have to wait days to get a partial answer at best.

Bottom line: Unless consent is captured via Apple’s ATT framework on both the publisher and advertiser apps, the only way to describe the relationship between your paid media and iOS conversions is through SKAdNetwork.

Ostensibly, ATT and SKAdNetwork are focused on consumer privacy and removing the ability to triangulate persistent identification of individual records using metadata like timestamps and device identifiers without the end users’ consent. All of the ad data required for attribution is sent directly to Apple servers from the OS (no middleware), such that no massive customer leakage can occur and it severs the measurement-targeting feedback loop marketers were used to.

Do consumers feel better about it? Probably, for those paying attention. But we have not seen a migration from Android to Apple. The world is still roughly 27% iOS / 73% Android, with a heavier skew in the US at 56% iOS users. This hasn’t materially changed since ATT and SKAdNetwork 2.0 were announced in June of ’20 at Apple’s Worldwide Developer Conference.

So, SKAdNetwork has created a lot of challenges for marketers. It’s opaque. It’s slow. And it’s so generalized as to be meaningless for performance insights in most cases, particularly SKAd 2.0 and below (which is sadly where most publishers are still stuck in terms of their adoption).

But the solution for many brands is obvious: Run on ASA! It’s real time, it’s deterministic, and it doesn’t live within the confines of SKAdNetwork’s rules. Whether any of us actually believes that ASA deserves 40% of the media funnel is a topic for another discussion.

SO WHAT DO YOU DO?

My first recommendation is to perform a test – pulse your ASA campaigns and see what happens. A two-week pause should do it in most cases. As you stopped spending on ASA, did you see your overall conversions decrease? You might. You might not.

But let’s say you do see a bump – meaning what you spent can be seen to have driven installs. What then? You need a way to understand the incrementality behind your spend; conversions tied to ad spend should increase or decrease reasonably as the spend moves. We can help marketers observe these fluctuations with our new Always-On Incremental Measurement (AIM) product.

AIM sits above the direct response attribution data marketers are accustomed to, applying media mix modeling and AI atop custom models built using two main aggregate inputs:

– Network cost/day/region/app

– Conversions by day/region/app

With always-on incremental insights, you can decrease unwarranted cannibalization, reducing your costs without starving genuine and incremental growth.

ASA is good for ‘closing the deal,’ and as long as it sits with unique advantages over other paid channels on iOS, we may as well all play along in trying to conquest competitors’ brands.

(Not to date myself, but I used to send cease & desist orders to other brands that were bidding on my brand’s keywords in Google search. It worked most of the time. The reason being twofold; it’s my brand, not theirs, and they could do undue harm depending on the offer; and overall channel confusion. Of the 14 times we sent a letter, it worked 12. Note, this was typically around the descriptions in the marketing language of the keyword – which doesn’t really apply in Apple’s case.)

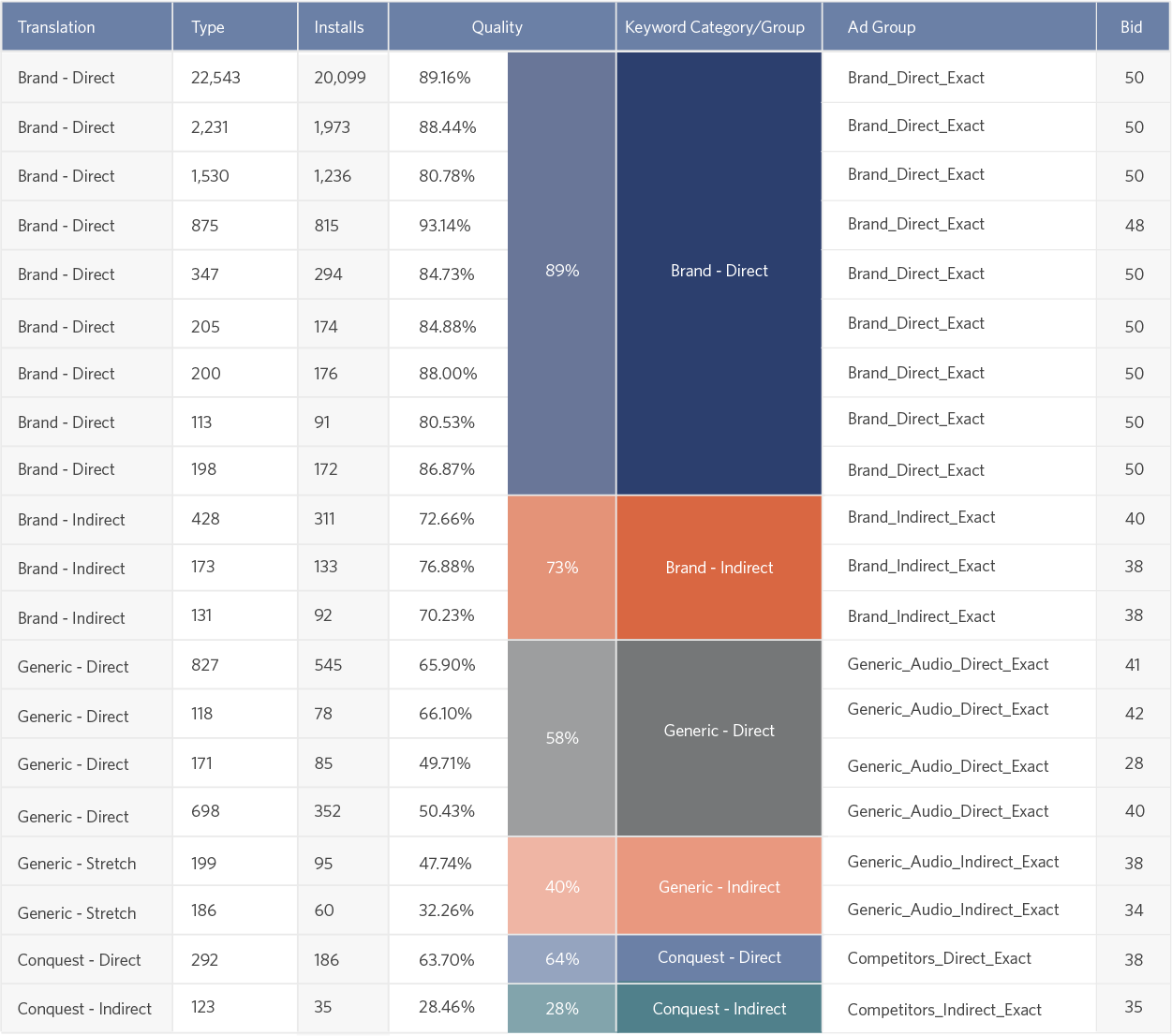

There are some real wins to be had, particularly in the generic and conquesting spaces. Understanding the quality of the performance tied back to the keyword is critical. It’s no big surprise that users searching your company name likely have a higher take rate in the app. After all, they ‘raised their hand’ to be part of the brand and got snared by a search ad, but they self-qualified, and it’s expected they would be a better long-term customer (i.e. higher quality). On the other hand, we see the quality really drop off below the brand terms – with a couple of exceptions in the conquesting space. This is where the opportunity lies, and it’s why Kochava built Search Ads Maven.

Search Ads Maven for ASA Optimization

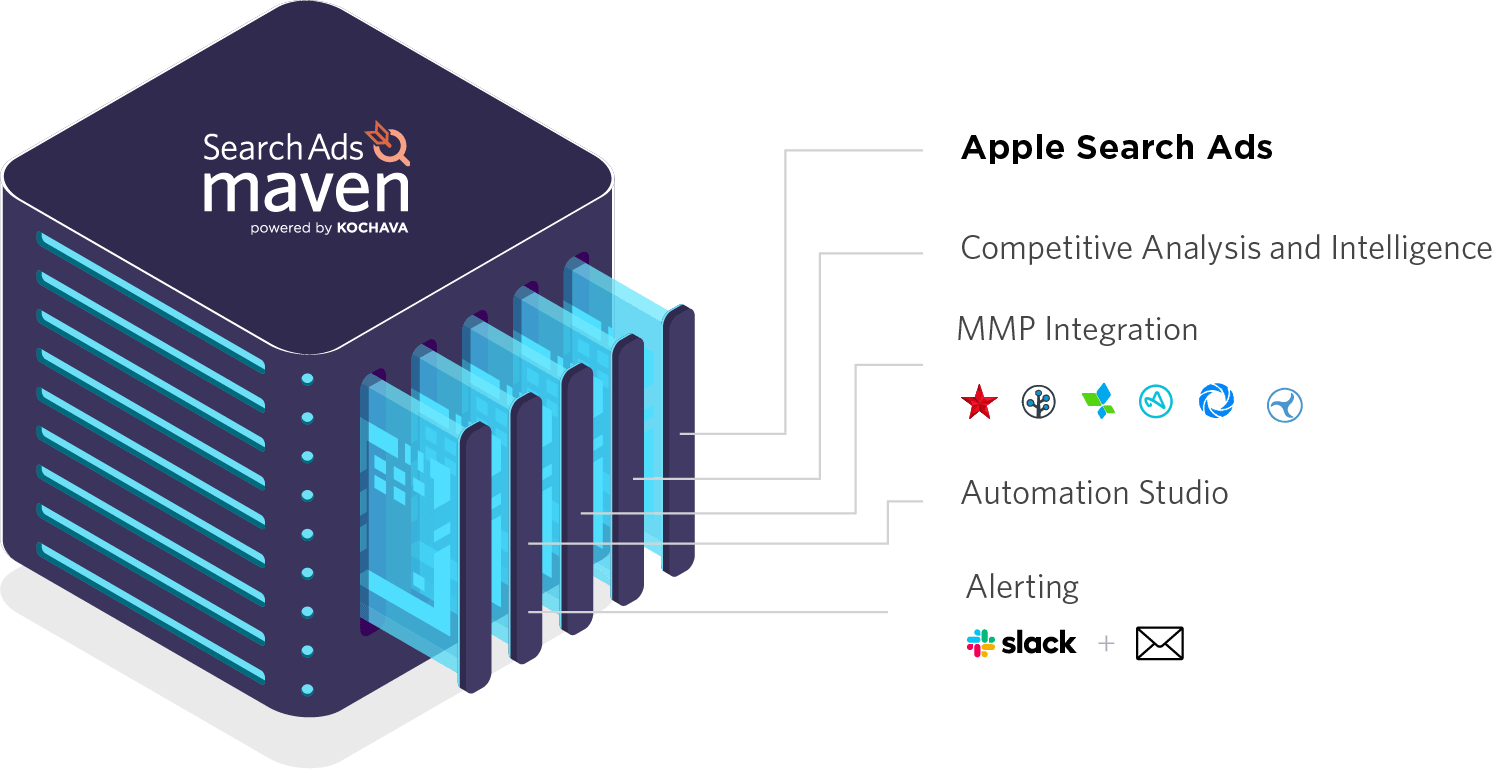

Search Ads Maven is an ASA campaign management platform that uses data connectors with Apple, app store optimization and keyword intelligence, and MMPs to automate your keyword bidding optimization based on install performance and lower funnel key performance indicators that are deterministic signals.

This is possible because ASA doesn’t live under the boot of SKAdNetwork. As such, you can do some VERY interesting things with it. For instance, the attribution is both real time and deterministic, plus the keyword code is actually written to the app binary on download and can be retrieved by the MMP. What does this mean?

It means there is a keyword tied to an actual device, thereby allowing post-install performance to be tied back to the keyword.

Quality in the keyword analysis table above refers to the number of installers who had a paid subscription within 7 days of installing. It becomes clear the ‘quality’ is much higher on the branded terms – these are the users who ‘raised their hand’ to the brand by searching for the actual company name (i.e., a brand effect, not a media effect). But there’s value to be won within the Generic and Conquest buckets as well, where we see significant variance in the quality of the customers. Not much can be done about winning more brand conversions, BUT building a solid, deterministic test-and-learn strategy within the non-brand terms is possible.

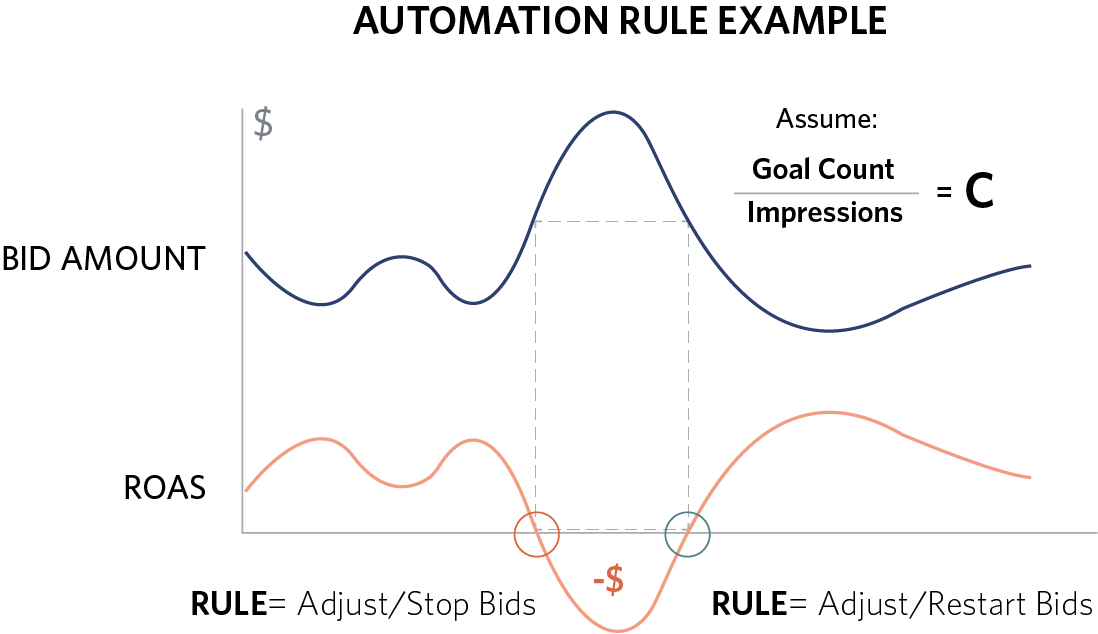

What no ASA marketer wants to see is an out-of-control keyword bidding war driving their ROAS into the red. With Search Ad Maven’s Automation Studio, marketers can customize rule logic based on a variety of triggers, including ROAS that takes into account in-app revenue or other custom goals based on post-install event data piped in from their MMP. Keyword bids can be paused when the winning bid cost drives ROAS into the “pit of despair,” as we like to call it, but then resumed again once positive ROAS territory is reached. Typically, this is something marketers only observe after the damage is done, but with Search Ads Maven, your positive ROAS can be maintained around the clock, 24/7/365.

Concluding thoughts

Mobile advertising has been forever altered on iOS. The days of funneling the majority of your spend to the duopoly as a sure bet are no more.

Don’t get me wrong; there are opportunities using SKAdNetwork, but it is confusing. We can help with an in-depth consultation that looks at your iOS app(s), understands your KPIs and business objectives, and tailors a SKAdNetwork configuration strategy that will squeeze out as much insight as possible. Just keep in mind that the vast majority of publishers and ad networks still aren’t set up to support SKAdNetwork, so your media mix options are limited.

If you’re ready to play the game on ASA (and really, you must at some level), don’t do it without a solid MMP at your back and a tool like Search Ads Maven to automate the actions based on keyword performance tied to lower funnel KPIs. There’s amazing potential for spend optimization, but doing it manually is painstaking when you have hundreds or even thousands of keywords.

Want to stay up-to-date on industry trends, like those discussed in this article? Visit www.kochava.com/adtech-trends/