Apple Search Ads rises as overall iOS attributions fall

Quick Takeaways

As iOS 15 gains traction, we’re taking a look back at Apple’s rollout of iOS 14, particularly iOS 14.5, and how it impacted the mobile advertising landscape.

iOS 14 was released on September 16, 2020, but without its most impactful component yet enforced—the AppTrackingTransparency (ATT) framework. It wasn’t until April 26th, 2021, when Apple dropped iOS 14.5, that they finally enforced the ATT framework. The industry was generally thankful for the delay, although it’s doubtful that delay proved productive for most marketers. The ATT framework required iOS apps to start prompting for user consent to app tracking if they wanted access to the Identifier for Advertisers (IDFA), plus the ability to perform certain advertising measurement and ad targeting. In the lead-up to its launch, advertisers were scrambling to anticipate the impact of large-scale IDFA opt-out and get geared up to support Apple’s SKAdNetwork. The SKAdNetwork provided a means of maintaining deterministic and yet anonymous attribution reporting for iOS acquisition efforts. While SKAdNetwork would help to fill some of the large holes left in the wake of widespread IDFA opt-out, the newness of its data model and the difficulty of adapting programmatic optimization algorithms to run on delayed, aggregated data from SKAdNetwork posed major challenges for ad networks looking to run on it. So let’s take a look at:

- How Apple paced the rollout of iOS 14.5

- The overall rates of prompting via the ATT framework

- Changes in iOS install attributions among Media Partners

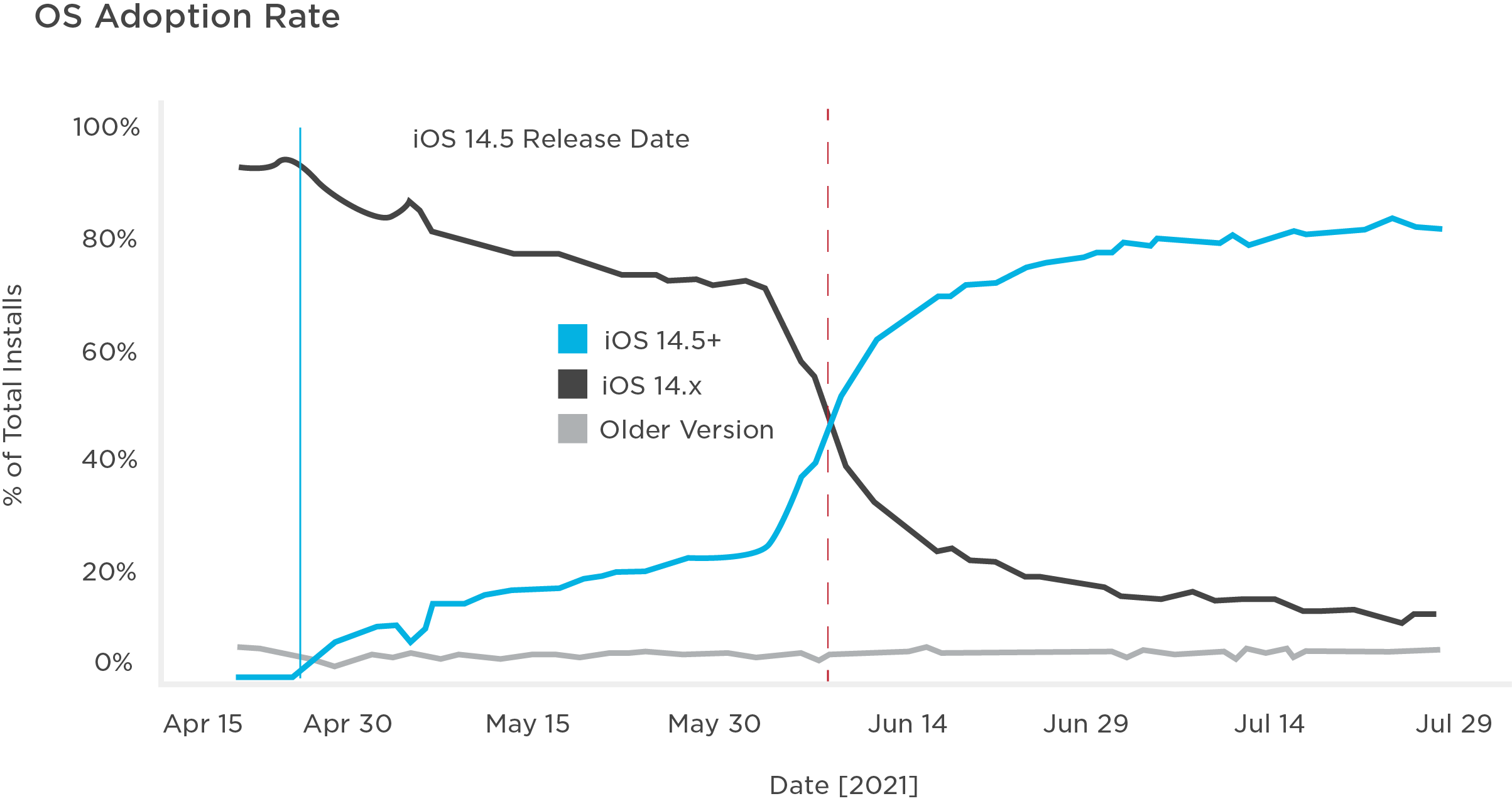

Pacing the iOS 14.5 roll-out

From the OS adoption rate graph below, one can see that Apple took a measured approach in slow-rolling iOS 14.5’s release at first. It wasn’t until the early part of June that they began scaling the update to more devices such that by June 9th the rubicon was crossed and a majority of total devices measured daily were hosting iOS 14.5. By late July, over 80% of all iOS devices were running on iOS 14.5.

ATT Prompting Rates and Opt-in Percentages

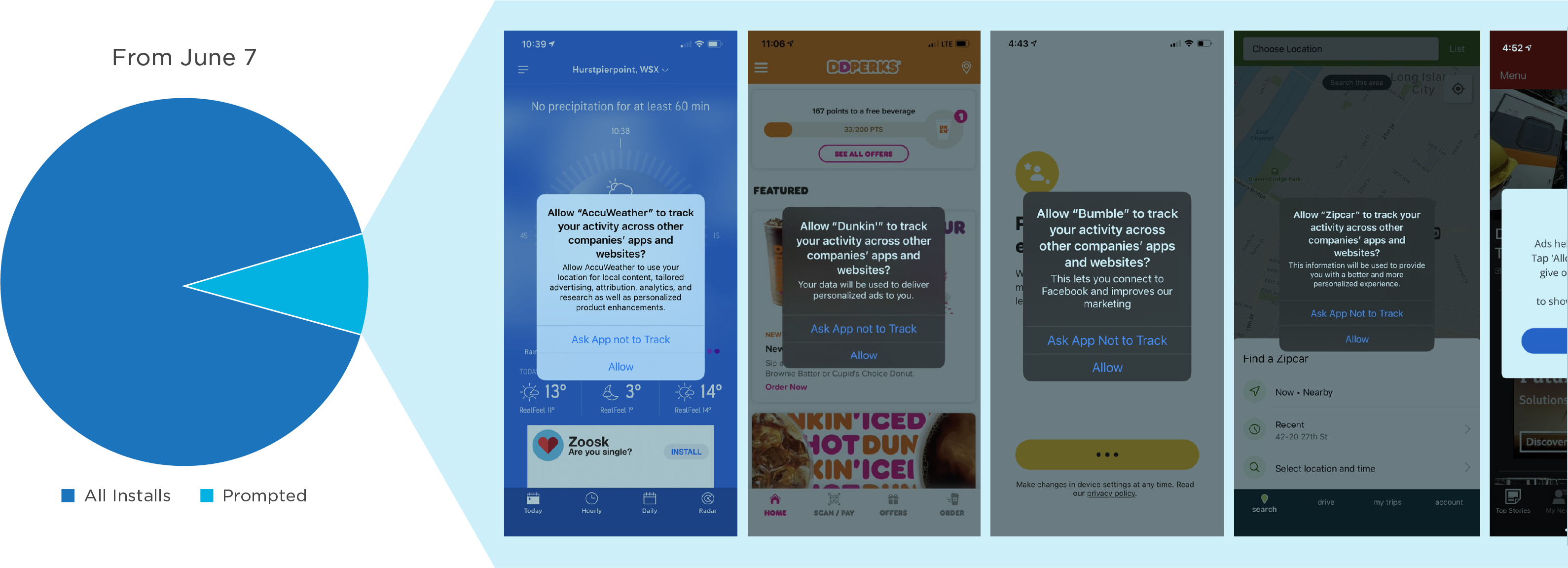

When the ATT framework went into enforcement on April 26th of this year, apps were not required to prompt, but not doing so meant there was no access to the IDFA as well as restrictions on ad targeting and measurement. As such, it was somewhat of a surprise to see such a small minority of apps actually implementing ATT prompting.

Looking from June 7th, 2021 into August, only 11% of all iOS app installs measured with Kochava had received the prompt. Most apps simply weren’t prompting or weren’t prompting prior to sending the install record to their mobile measurement partner (MMP).

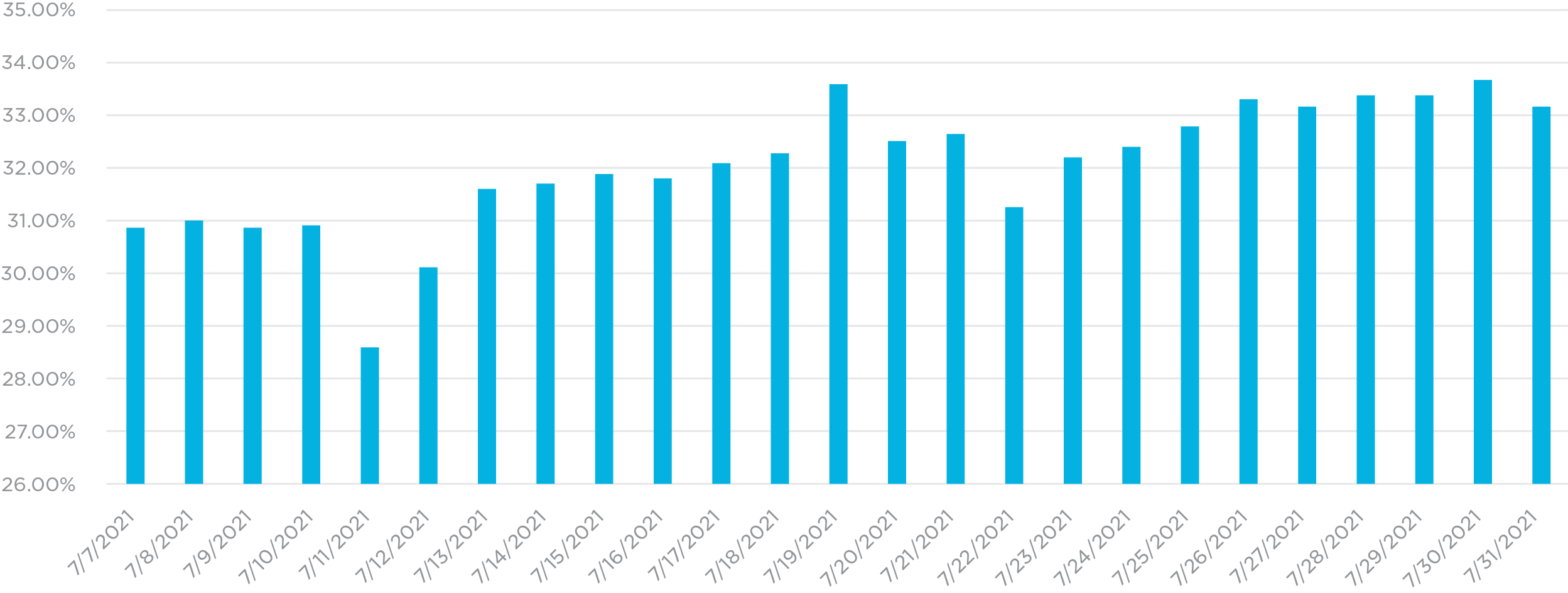

Further, actual opt-in rates from those users who were prompted, we’re hovering in the low 30% range. The chart below includes users prompted, as well as those who were opted into ATT by default because Limit Ad Tracking (LAT) was already enabled prior to iOS 14.

ATT opt-in rates that only factor in those users who actually receive a prompt and make a choice often trend northward into the high 30% range or lower 40% range.

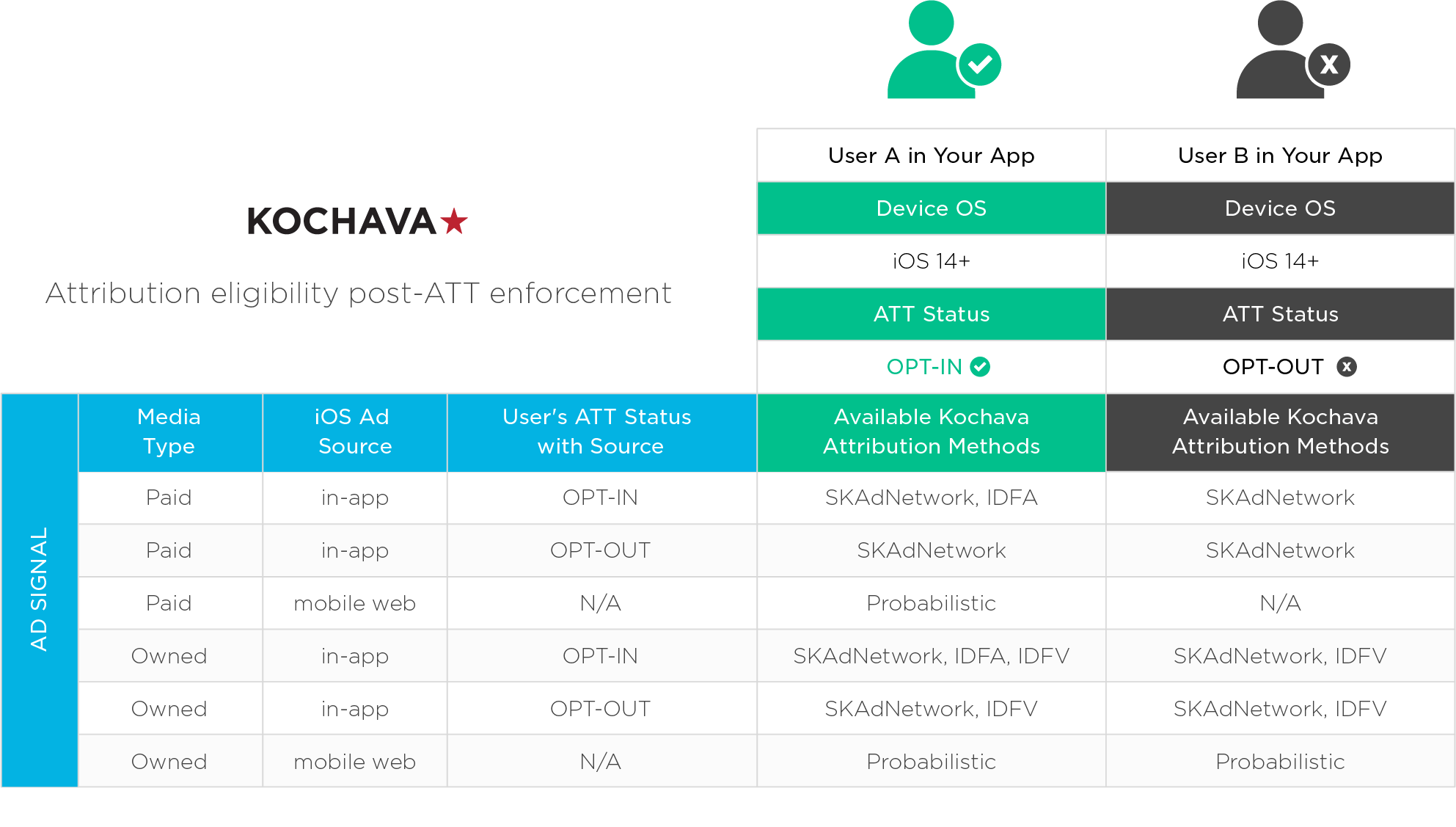

Either way, it’s important to remember the impact that ATT opt-in, or lack thereof, has on attribution. To have a conversion attributed on the IDFA requires that a user has consented in both the source app where the ad is served, as well as the target app where the user converts. Kochava witnessed IDFA-based attributions drop by over 44%.

The chart below illustrates attribution options based on the combined ATT opt-in status of the user in the target app versus the ad source.

The great redistribution of attributed install volume

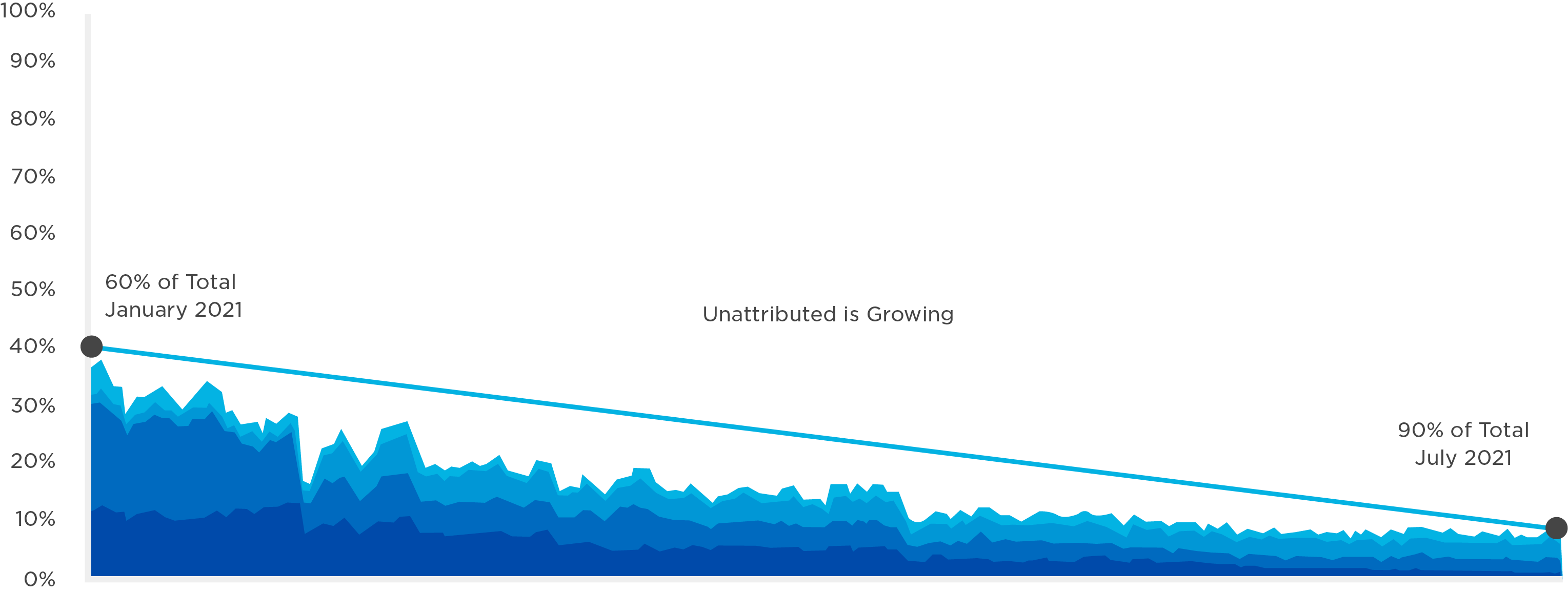

With all of the challenges marketers are facing on both the supply side and demand side, overall media spend is down on iOS to such an extent that over 90% of all iOS install attributions are unattributed as of late July 2021. That means 10% or less of iOS installs are being attributed to media. In January 2021, nearly 40% of iOS installs were being attributed. Marketers are less likely to spend where they cannot effectively measure the outcome of their ad dollars.

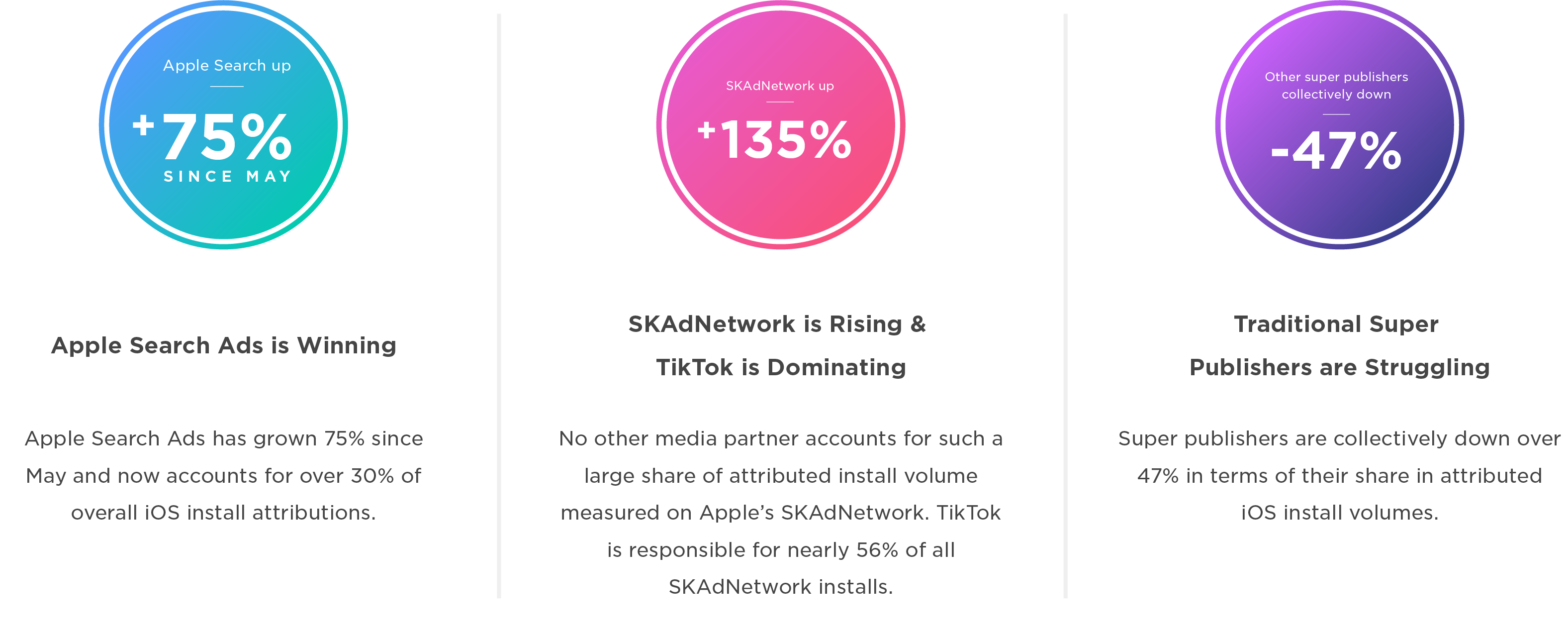

Among the dwindling percentage of app installs that are still being attributed, a great redistribution has taken place. Per the infographic below, Apple Search Ads (ASA) is taking a clear lead—jumping 75% between May and July this year and only continuing to climb. SKAdNetwork is picking up momentum with a 135% jump in volume (although it’s far off from overtaking Apple Search Ads’ position). In fact, of all iOS install attributions, SKAdNetwork and ASA combined now account for 40%. On the SKAdNetwork front, TikTok in particular accounts for the overwhelming majority of SKAdNetwork volume compared to other networks that support the framework. Most of the major super publishers are collectively down over 47%.

Further, in the face of the ATT framework and SKAdNetwork, a larger chunk of owned media efforts are being measured probabilistically, since Apple’s user privacy and data use policy doesn’t prohibit the use of IP address and user agent for attribution when it’s for comparing a company’s own website or app data with its own data.

Takeaways

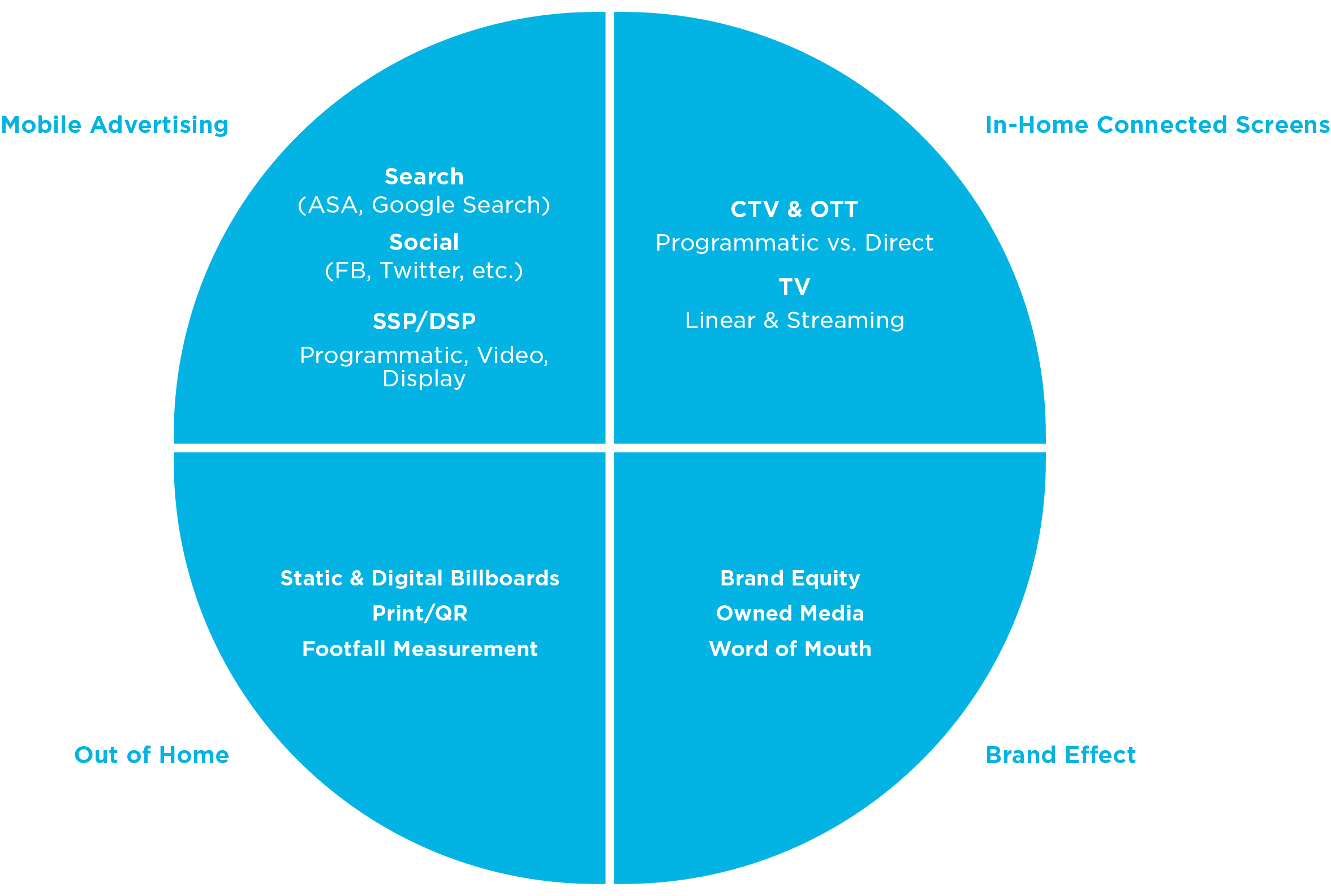

Marketers are being challenged right now to adapt their iOS growth efforts to a new normal. iOS installs aren’t declining, just the ability to correlate ad spend to them via certain channels. Mobile marketers should be inclined to look to the larger world of marketing channels beyond mobile, many of which can be measured with the help of Kochava MediaLiftTM, which provides incremental lift measurement that’s not reliant on the row-level device or user data that became so customary with programmatic mobile marketing. Nothing is truly organic and here at Kochava, we believe in helping marketers attribute everything to truly understand cause and effect in their marketing.

If you’re struggling in the face of Apple’s changes regarding iOS 14+, contact us for a free consultation to learn how we can help.

Stay up-to-date by subscribing to our newsletter.